First Quarter 2021 Financial Results Highlights

· Number of orders increased to 34.1 million growing by 161% year-on-year, compared to 13.1 million orders delivered in Q1 2020.

· GMV incl. services increased to RUB 74.2 billion, with growth reaching 135% year-on-year, compared to RUB 31.6 billion in Q1 2020.

· Share of Marketplace reached 58.4% as percentage of GMV incl. services, compared to 32.6% in Q1 2020.

· Adjusted EBITDA was negative RUB 4.9 billion, which is comparable to negative RUB 4.5 billion in Q1 2020, with Adjusted EBITDA as percentage of GMV incl. services improving to negative 6.5% from negative 14.2% in Q1 2020.

· Cash flow from operating activities was negative RUB 12.1 billion, compared to negative RUB 2.4 billion in Q1 2020, driven by the seasonal cash outflow on the back of trade payables due in Q1, following the strongest Q4 2020 trading in Company’s history.

Alexander Shulgin, Chief Executive Officer of Ozon commented: “We had a fantastic start to the year, with 135% GMV growth in Q1, marking the sixth quarter in row with GMV growth exceeding 100%. We are encouraged by our progress year to date, and raised our GMV growth outlook for the full year to 100% growth year-on-year. Ozon marketplace remains the core growth engine for the Group, and continues to scale fast, boosted by rapidly increasing number of merchants joining the platform and 16 million active customers regularly shopping at Ozon. In April we announced the Oney Bank acquisition, marking a new milestone in the development of our financial services vertical. The deal will help Ozon to expand the range and improve quality of the B2B and B2C products offered to our merchants and customers. Finally, Ozon is expanding in CIS with planned operations launch in Belarus.”

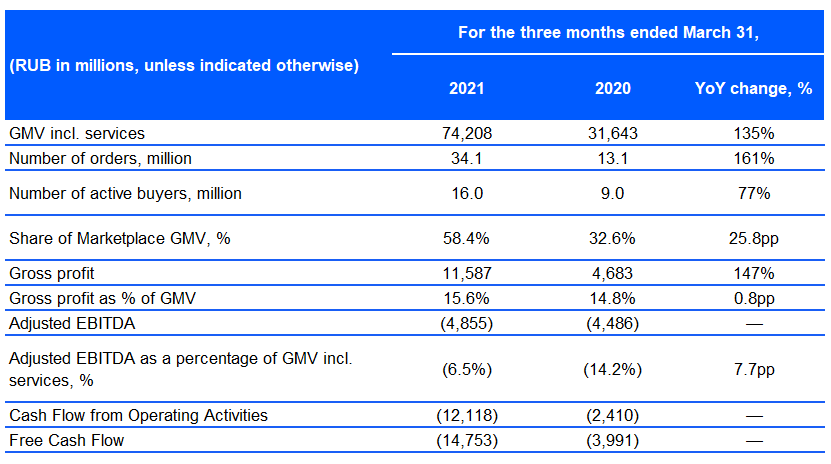

Summary: Key Operating and Financial Metrics

The following table sets forth a summary of the key operating and financial data for the three months ended March 31, 2021. The quarterly information for the three months ended March 31, 2021 and 2020 has not been audited by the Company’s auditors.

Note that Adjusted EBITDA and Free cash flow are non-IFRS financial measures. See “Presentation of Financial and Other Information” section of this press release for a definition of such non-IFRS measures, a discussion of the limitations on their use, and reconciliations of the non-IFRS measures to the applicable IFRS measures. See the definitions of metrics such as GMV incl. services, Gross Profit, number of orders, number of active buyers, share of Marketplace GMV in the “Other Key Operating Measures” section of this press release.

Financial Outlook

The below forward-looking statements reflect Ozon’s expectations as of May 18, 2021, taking into account trends year to date and could be subject to change, and involve inherent risks which we are not able to control, for example the overall impact of the coronavirus pandemic and any ongoing or new potential disruptions caused by COVID-19. The below forecasts assume no further escalation of the COVID-19 pandemic.

· Ozon raises growth guidance for the Company’s GMV incl. services to 100% for Full-Year 2021, compared to Full-Year 2020.

· Ozon reiterates capital expenditure plans of between RUB 20 billion to RUB 25 billion for the Full-Year 2021.

Key Business Developments

Ozon Marketplace

In Q1 2021 Share of Marketplace as percentage of GMVreached 58.4%, almost doubling from 32.6% in Q1 2020, as a result of the rising order frequencies, the rapid growth in the number of active customers which reached 16 million, and assortment expansion. In addition, the growth was augmented by the merchant base quadrupling year-on-year, on the back of continuous improvement in the level and quality of service offered to the sellers, including fulfillment and logistics, business analytics tools, and access to a large customer base, further supported by effective adjustment in commission rates during Q1 2021.

Buyers

Ozon experienced extensive growth in the number of active customers as well as significant increase in the frequency of orders. The Company believes these trends weredriven by improvement in speed and reliability of delivery, and significantly greater choice due to much wider assortment.

· Number of active buyers on Ozon’s platform increased by 77% year-on-year to 16.0 million as of March 31, 2021, compared to 9.0 million as of March 31, 2020.

· Annual order frequency of Ozon’s buyers increased by 33% to 5.9 in Q1 2021, compared to 4.5 in Q1 2020.

Assortment

· Assortment increased nearly 2.5x year-on-year and reached 19 million SKUs, driven by substantial growth in seller base and more frictionless content creation process.

Sellers

Strong growth in seller base continued in Q1 2021, with the number of active sellers nearly quadrupling year-on-year compared to Q1 2020.

· The launch of fulfillment and sorting facilities in the regions located closer to the regional seller base led to greater traction with the regional sellers.

· Following adjustment to the commission structure in February 2021 and improvement in the breadth and quality of services offered by Ozon to its merchants, the number of sellers onboarded onto Ozon marketplace has been growing rapidly.

Product Development

During Q1 2021 Ozon continued to roll out new product initiatives for its merchants and its multi-million customer base.

· In March 2021 Ozon marketplace expanded its offering to the sellers with a new Storefront model, which enables sellers to facilitate deliveries to customers independently while using the marketplace as a digital storefront.

Fulfillment & Logistics

Ozon operates one of the largest and widespread network of fulfillment centers and diversified last mile logistics infrastructure in Russia allowing for faster and more reliable delivery, evidenced by all-time high 98% On-Time ratio in Q1 2021.

Fulfillment:

· In Q1 2021 Ozon launched a fulfillment center in Yekaterinburg and the overall footprint as of March 2021 reached 250,000 square meters in Moscow, Moscow region, Tver, Saint-Petersburg, Kazan, Rostov-on-Don, Yekaterinburg, and Novosibirsk.

Logistics:

· In Q1 2021 Ozon continued to actively expand its last-mile network, by leveraging its pick-up points franchising model.

· As of March 31, 2021, Ozon operated over 12,000 offline pick-up locations.

Third Party Logistics Services

· Ozon launched logistics service solutions for third parties. As part of the new service, Ozon aims to partner with businesses across Russia planning to migrate online and provide reliable and convenient logistics solution. The provision of the services to the third parties creates a new revenue stream for Ozon and should allow Ozon to increase capacity utilization during the low season.

· In Q1 2021 Ozon began delivering goods from the international online furniture and home goods store IKEA. Now IKEA products can be delivered via Ozon courier or collected at the Ozon pick-up point. The service is already available to the residents of Moscow and the Moscow region. It is planned to launch delivery for IKEA at Ozon pick-up points throughout the country.

Ozon New Initiatives & Verticals

Ozon Financial Services

Oney Bank and Banking License Acquisition

Ozon continues the development of its B2B and B2C payment and lending business streams. On April 12, 2021 Ozon entered into an agreement to acquire Oney Bank LLC from Ozon longtime partner Sovcombank. Ozon aimed to acquire an asset which the Company can integrate into its fintech business in a fast and efficient manner. The acquisition of Oney Bank will allow Ozon to obtain a banking license. This will offer the Company full flexibility to structure and launch financial service products for its customers and marketplace sellers in accordance with their desired specifications. The acquisition should allow to provide faster payment services at lower commissions.

B2C Initiatives

· Number of Ozon card holders increased significantly in Q1 2021. The number of Ozon cards users exceeded 780,000 by the end of March 2021, of which almost half was issued in digital format.

· Ozon card holders exhibit greater customer loyalty with 1.6x higher order frequency on average in 12-month period ended March 31, 2021, compared to the customers using other payment methods.

B2B Initiatives

· Within the B2B financial services Ozon is focusing on lending solutions which enhance the retention of the existing merchants and attract more sellers to Ozon’s platform. The lending solutions are developed in partnership with a number of financial institutions in Russia such as Otkritie Financial Corporation, MTS Bank, Alfa Bank and a range of micro-credit organizations.

· “Flexible payment plan” solution is a unique product structured with our partners which enables marketplace sellers to arrange a payment schedule that best fits their business needs, leading to greater loyalty and higher sales volumes, without significant impact on the working capital dynamics.

Ozon Express

· During Q1 2021, Ozon Express continued to expand its operations, gain popularity thanks to a large and diverse assortment and expedient delivery. In March 2021, the average daily order volume more than doubled compared to December 2020 and number of orders for Q1 2021 was 10x higher compared to Q1 2020.

Ozon International Operations

OZON CIS Expansion

As part of Ozon CIS expansion strategy the Company aims to launch its own logistics and delivery channels in Belarus this year. Stanislav Kondratyev, Director of Logistics and Customer Service at Ozon commented: “Belarus is a strategically important market for Ozon. The Company has already formed a loyal audience in Belarus, but we see significant growth potential. We aim to consistently improve the experience of our Belarusian clients. We also intend to help Belarusian manufacturers sell goods to the Russian audience of Ozon”.

COVID-19

In March 2020, the World Health Organization declared the COVID-19 virus a global pandemic. The COVID-19 outbreak continues to evolve globally and the full impact that the pandemic will have on the Group’s financial condition, liquidity, and future results of operations cannot be fully ascertained at this stage.

In 2020 the Russian Government implemented the restrictions such as social distancing, self-isolation and other quarantine measures from the end of March 2020 until June 2020. The lockdown in most regions of Russia was eased starting from June 2020. Nonetheless, strong GMV growth trends continued at Ozon, with strong customer and merchant engagement on the platform in 2H 2020. These trends continued in 2021 so far. In Q1 2021 GMV growth reached 135% year-on-year, with rising order frequencies and improved retention.

Contacts

Investor Relations

Maryia Berasneva, Head of Investor Relations, OZON

ir@ozon.ru

Press Office

Maria Zaikina, Director of Public & Industry Relations, OZON

pr@ozon.ru

________________________________________________________________________

Disclaimer

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that reflect the current views of Ozon Holdings PLC (“we”, “our” or “us”, or the “Company”) about future events and financial performance. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking statements.

These forward-looking statements are based on management’s current expectations. However, it is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. These statements are neither promises nor guarantees but involve known and unknown risks, uncertainties and other important factors and circumstances that may cause Ozon’s actual results, performance or achievements to be materially different from its expectations expressed or implied by the forward-looking statements, including conditions in the U.S. capital markets, negative global economic conditions, potential negative developments in the COVID-19 pandemic, other negative developments in Ozon’s business or unfavorable legislative or regulatory developments. We caution you therefore against relying on these forward-looking statements, and we qualify all of our forward-looking statements by these cautionary statements.

These and other important factors could cause actual results to differ materially from those indicated by the forward-looking statements made in this press release. Any such forward-looking statements represent management’s estimates as of the date of this press release. While Ozon may elect to update such forward-looking statements at some point in the future, Ozon disclaims any obligation to do so, even if subsequent events cause its views to change. These forward-looking statements should not be relied upon as representing Ozon’s views as of any date subsequent to the date of this press release.

This press release includes certain non-IFRS financial measures not presented in accordance with IFRS, including but not limited to Contribution Profit/(Loss), Adjusted EBITDA and Free Cash Flow. These financial measures are not measures of financial performance in accordance with IFRS and may exclude items that are significant in understanding and assessing our financial results. Therefore, these measures should not be considered in isolation or as an alternative to loss for the period or other measures of profitability, liquidity or performance under IFRS. You should be aware that the Company’s presentation of these measures may not be comparable to similarly titled measures used by other companies, which may be defined and calculated differently. See “Presentation of Financial and Other Information” in this press release for a reconciliation of certain of these non-IFRS measures to the most directly comparable IFRS measure.

This press release includes quarterly information for the three months ended March 31, 2021 and 2020. The quarterly information has not been audited or reviewed by the Company’s auditors.

The trademarks included herein are the property of the owners thereof and are used for reference purposes only. Such use should not be construed as an endorsement of the products or services of the Company.