- Ozon is one of the biggest companies in the Russian e-commerce industry. It is the largest multi-category online store. Ozon provides the marketplace for 3P sellers and sells goods independently.

- The e-commerce industry in Russia develops rapidly and has high potential. It also has several differences from the industries of other countries of emerging markets.

- Previous years were extremely successful for the company in terms of the growth rate. Due to a good business model, Ozon can increase its market share and, consequently, sales.

- Ozon managed to start cutting operational and advertising expenses. However, there is still a long way to sustainable profitability.

- Ozon is expected to increase its revenues together with the growth of the market. The estimated revenue CAGR for the next 4-5 years is about 40%.

Investment Thesis

Ozon Holdings (NASDAQ:OZON) is one of the leaders in the Russian e-commerce market. The industry is growing rapidly and the company is taking advantage of it. It has a high historical growth rate of revenue and very positive forecasts. Moreover, it develops the marketplace and logistic infrastructure, therefore some costs will decrease in the next years and Ozon will become a profitable company. Ozon as an investment carries certain risks (which are covered in the article), but it might become very profitable in the next couple of years.

Note that Ozon held an IPO during the "IPOs boom" and its current price might be slightly overvalued due to high expectations of the business development. The company's stock price grew almost 50% from originally expected after the first trading sessions. The company held an IPO at the right time. Anyways, Ozon shares still have room for price gains.

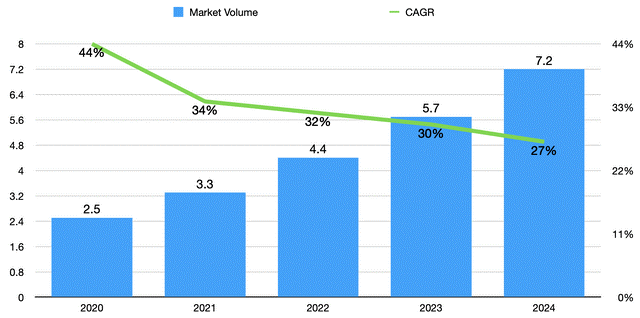

Russian e-commerce industry still has a long way to go. Despite the fact that about 80% of the population in Russia has access to the Internet, the share of e-commerce in the retail industry is relatively small. According to the head of the Association of Russian E-Commerce Companies, it might reach 11% of whole retail in 2021 (the source in the Russian language). Nevertheless, the CAGR is estimated at the level of over 30% for the next 4-5 years. Ozon has a strong position in the market and can increase it during the next years.

Business Overview

Ozon Holdings is the oldest online retailer in Russia, which was founded in 1998. The company started as a book and the VHS web-store turned into a giant of multi-category consumer products. According to the Data Insight research (the source in the Russian language), Ozon was the 3rd biggest online store overall and the largest multi-category online store, as of the end of 2019. The company offers a range of various products, including electronics, FMCG, consumer goods, apparel, and others. Not so long ago, Ozon launched the marketplace, where third-party sellers can offer their goods to the customers along with Ozon itself.

The key competitive advantages of Ozon:

- Good logistic network. Ozon has a highly efficient delivery network in the European part of Russia that covers about 40% of the Russian population with 1-day delivery.

- Recognizable brand and decent customer loyalty. Ozon has the most recognizable brand over its competitors. Year over year, the company increases customer loyalty. There were 11.4 mn active buyers as of September 30, 2020.

- Well-diversified business model. The comparison of Ozon and Amazon (AMZN) isn't really fair. Yes, Amazon started as a web-store, but it turned into a technological giant, while Ozon diversifies its business in the field of e-commerce and FinTech. In addition to the 3P marketplace, the company's biggest businesses are Ozon.Card (FinTech JV together with Russia-based payment system), Ozon.Travel (web-service for booking travel tickets) and LitRes (e-book and audiobook online store, Ozon holds 42.27%).

You can find more detailed data about the company in its Presentation.

Russian E-Commerce Market Analysis

2020 completely changed the e-commerce industry. Despite the increase in the market volume, Internet users successfully adopted new services. The events that took place in 2020, especially the lockdown, sharply boosted the revenues of e-commerce companies. According to various estimates, the industry growth rate ranged from 34% to 50% (both sources are in the Russian language). The estimations of the 2020 market volume range from 2.7 trillion RUB (~36 bn USD) to 3.3 trillion RUB (44 bn USD).

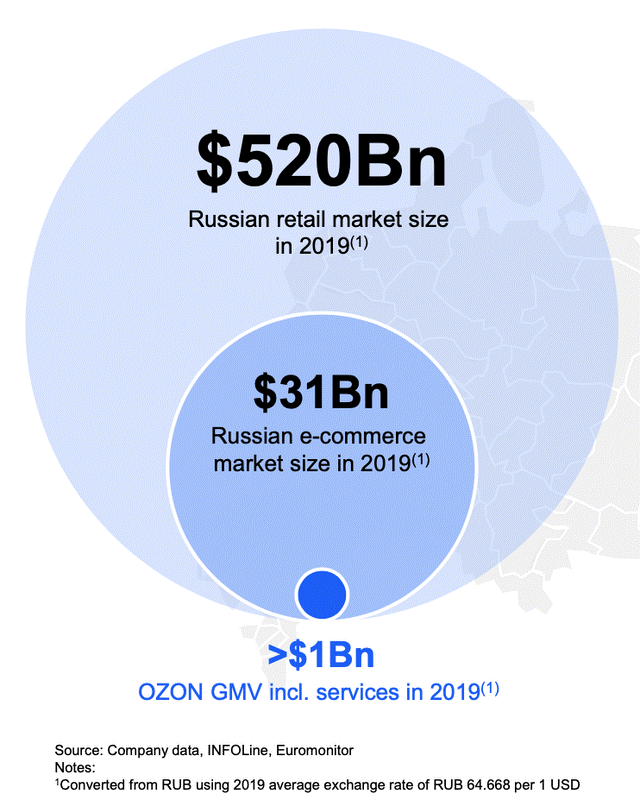

Moreover, 2019 was a quite successful year for the companies of the e-commerce industry as well. The market grew by ~28% compared to 2018 (the source is in the Russian language). Different sources provide various estimations of market volume in 2019. The one on the picture was provided by Ozon in its Investor Presentation.

Source: Ozon Investor Presentation

According to the picture, in 2019, share of e-commerce was ~6% of the whole retail market. Data Insights provides more detailed data. The analytics expect that in 2024 the share of e-commerce in Russia will reach 19% of the whole retail industry.

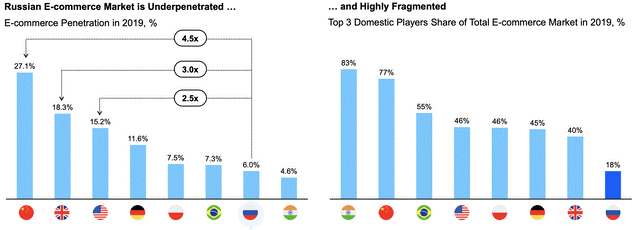

The high growth rate of the market is based on the fact of underpenetration of e-commerce despite the fact of decent Internet penetration. Russian e-commerce industry is several times smaller than the world's leading markets. People still do not trust e-commerce and online shopping, although it has changed a lot in 2020. Another problem is obvious: difficulties in building infrastructure due to the size of the country (even though the majority of the population lives in the European part of the country).

Forecasted growth rates are what makes the Russian e-commerce market enticing. Different analytics foresee different prospects, nevertheless, all of them are quite positive. INFOLine forecast, which Ozon uses in its presentation materials, expects the e-commerce industry to reach a market size of 7.6 trillion RUB in 2025 with a CAGR of 25%. Data Insight provides a different outlook, which is slightly more positive (the source is in the Russian language). According to it, the industry is estimated to reach 7.2 trillion RUB in 2024 with the 2020-2024 CAGR of 33.2%.

Source: created by the author using data from Data Insight (the source is in Russian)

The main competitors of Ozon

The Russian e-commerce market is low consolidated. There are a lot of companies, but mostly they sell goods of one segment. However, the biggest players are multi-segment, as is Ozon. Ozon is the only public e-commerce company, others are either private, or divisions, or joint ventures.

Wildberries

Wildberries (private company) is the largest e-commerce in Russia (in terms of revenue). Started as the women's clothing marketplace, it turned into a multi-category web-store. Nonetheless, women's clothing and accessories generate most of the sales so far. Wildberries builds its own logistic infrastructure within the whole country, which gives a quick delivery advantage and cheaper returns.

Financially, this is a stable company. Same as any other retailer, its margins are low. However, in comparison to Ozon, Wildberries is a profitable company. In 2020, company's earnings grew by 96% (the source is in the Russian language). Moreover, it increased the number of sellers more than fourfold, from 19 thousand to 91 thousand.

Yandex.Market

Yandex.Market was launched in the year 2000 as a multi-category goods aggregator. Later, in 2018, Beru was founded as a marketplace for Yandex.Market by Yandex (YNDX) and Sberbank (OTCPK:SBRCY) (OTCPK:AKSJF). In the fall of 2020, the joint venture was reformed: Yandex becomes the only owner of the company. Nowadays, Yandex.Market operates both as an aggregator and marketplace. Its market share is relatively small. However, it's growing very fast. Since Yandex is the biggest website in Russia, it easily promotes its products.

Yandex reports that in 3Q 2020, GMV of the marketplace increased 134% in comparison with Q3 2019, while revenues grew 55%. Still, the e-commerce division is unprofitable with 1.2 bn RUB (the losses decreased by 50% within a year). Yandex.Market is the third largest marketplace in Russia.

AliExpress Russia

AliExpress Russia was created in 2019 by Alibaba Group (BABA), MegaFon, Mail.ru Group (OTC:MLRUY) (OTC:MLRYY), and Russian Direct Investment Fund. Alibaba holds 48.75% of the joint venture. The company's market share is quite small comparing to Ozon's. The analysts estimate the current turnover at 6 mn USD and they expect it to reach 10 bn USD in 2022-2023. Also, the company could consider IPO in 3-4 years.

The key competitive advantage of AliExpress Russia is its cross-border nature. It is close to Chinese suppliers, which creates an extra advantage. Moreover, the population of Russia is quite familiar with the brand and it has a decent reputation for low prices.

Sberbank

Sberbank of Russia is actively developing an omnipresent ecosystem. Right now, there are various brands, including delivery services and banking. However, it currently doesn't include a marketplace, and Sberbank is looking for it. Recent news says that Citilink, which is one of the largest Russian online retailers (whose main product is consumer electronics), might become an acquisition target. It will allow Sberbank to enter the e-commerce market with a strong position in the consumer electronics segment.

Financial Performance

The financial performance of Ozon is controversial. The company put loads of money into advertising and development, therefore creating strong perspectives. However, there are several problems at the moment. The company will announce 4Q and FY2020 financial results on the 30th of March.

Source: Ozon Investor Presentation

During 2020, the company vastly improved its financials. The revenues grew significantly. However, that's not the most important fact. Here are the key points of the company's earnings:

- Adj. EBITDA margin rose in the second half of 2020 and reached -4.2% according to 3Q 2020.

- The company earned a positive operating cash flow in Q3 2020 due to several factors, but one of the most important was a ~20% growth of profits (from -61.1 mn USD to -49.9 mn USD)

- Ozon is estimated to reach the break-even rate in 2024. However, until 2023, the growth of revenues won't sustain the growth of profits. The margins of the sales might decrease in the short term.

- The estimated growth of the company's revenues is about 40%, whilst earnings are expected to grow 35.3% annually.

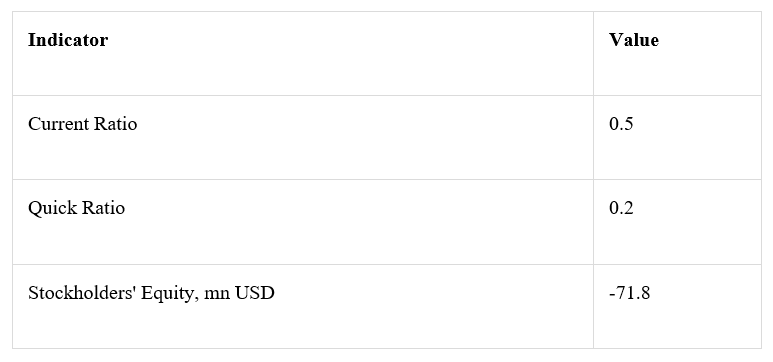

Profitability is not a vital issue for a fast-growing company like Ozon. Yet, there are other financial problems that might affect the company in a short term. The first of them is the high level of debt. Consequently, the company's quick and current ratios are lower than the industry's mean. In case that Ozon will have problems with sales or suppliers, the company may be on the verge of bankruptcy. Another problem is negative stockholders' equity due to high accumulated losses. It might result in the same issues as liquidity ratios. However, the probability of such events is quite low due to the strong market position of Ozon.

Risks and Opportunities

It is vital for Ozon to sustain stable growth in sales. The company has the features of a startup, such as high debt and retained losses, negative shareholders' equity, and high expected growth. Therefore, any risk can damage its future. Here are several risks, that may affect Ozon:

- High competition in Russian e-commerce. Currently, Ozon has strong positions and a decent market share. However, the industry changes rapidly: there were several loud bankruptcies and mergers.

- The e-commerce industry heavily relies on economic conditions. The consumer capacity of the population affects the company's sales. In case it decreases (what happens quite often), the sales might fall. The same situation is with the currency. Since most of the goods on the marketplace are imported (especially electronics), their prices are affected by the exchange rate in the long term.

The opportunities together with the estimated market growth outweigh negative risks.

- Inclusion in MSCI Russia. The rebalancing results will be announced on February 9 and will take effect on the 1st of March. Ozon is expected to be included in the index and form 1% of it. This will definitely support the stock in the short term.

- Ozon might become the leader of the industry. As it was mentioned before, there is no obvious leader in Russian e-commerce. Ozon and Wildberries compete for first place. However, Ozon's profits rely less on a particular category (its range of products is much wider). The company might take a leadership due to the fast development of the marketplace and capable logistic infrastructure.

- The industry might grow faster than expected. The changes in the industry are unpredictable. 2020 had a huge impact, and no one knows what could happen in the future.

Conclusion

Overall, Ozon is a risky investment, but it has extremely high potential. The e-commerce industry in Russia has high potential and Ozon is the best way to invest in it. Do not expect share prices to soar in one day, it will be a steady growth during the next several years. The most important factors to watch are the economic condition of Russia and Ozon's competitors. Both of them might affect sales, therefore creating financial problems for the company.

Original article: https://seekingalpha.com/article/4402967-ozon-holdings-main-beneficiary-of-russian-e-commerce-growth