Ozon Holdings PLC (NASDAQ and MOEX: “OZON”, thereafter referred to as “we”, “us”, “our”, “Ozon” or the “Company”), an operator of the leading Russian e-commerce platform, provides further update in respect of its $750 million 1.875 per cent. senior unsecured convertible bonds due 2026 (“Bonds”) issued by the Company with ISIN: XS2304902443.

As announced in the Company’s press releases dated October 25, 2022 and December 23, 2022, the Company has received a license from the U.S. sanctions authority regarding, and approval from the Cyprus Enforcement Unit for the Financial Sector (MEK) to implement, the consents and amendments to the terms and conditions of the Bonds on the terms set out in the written resolutions duly passed on October 25, 2022 (the “Restructuring”) by the holders of over 75 per cent. in principal amount of the Bonds outstanding (the “Written Resolutions”). Unless otherwise defined, capitalized terms used herein have the meaning given to them in the Written Resolutions.

As announced in the Company’s press releases dated January 30, 2023, and March 14, 2023, the Company has been awaiting response from the UK sanctions authority indicating that no license or authorization is required in connection with the Restructuring or granting a license or authorization to implement the Restructuring. The Redemption Long Stop Date was extended to March 15, 2023 and then to March 31, 2023.

The Company hereby announces that the UK sanctions authority published, on March 28, 2023, general license INT/2023/2824812 relating to ‘Bond amendments and restructurings for non-Designated Persons’ (the “License”) which authorizes bond issuers and UK persons to effect the terms of the bond restructurings subject to certain conditions. The Company hereby confirms that the Restructuring and its implementation falls within the scope of the License.

Accordingly, pursuant to the Written Resolutions, the UK/EU/US Sanctions Approval Satisfaction Date has now occurred. Consequently, the Effective Date has occurred as of the day of this announcement.

The holders of the Bonds which have not submitted validly completed Eligibility Instructions are entitled to deliver validly completed Eligibility Instructions to the Information, Tabulation and Settlement Agent on or before the Cut-off Time, being 4.00 p.m. London time on Wednesday April 5, 2023, in order to receive the USD Cash Redemption Amount on the Settlement Date or, as applicable, the RUB Cash Redemption Amount during the RUB Settlement Period.

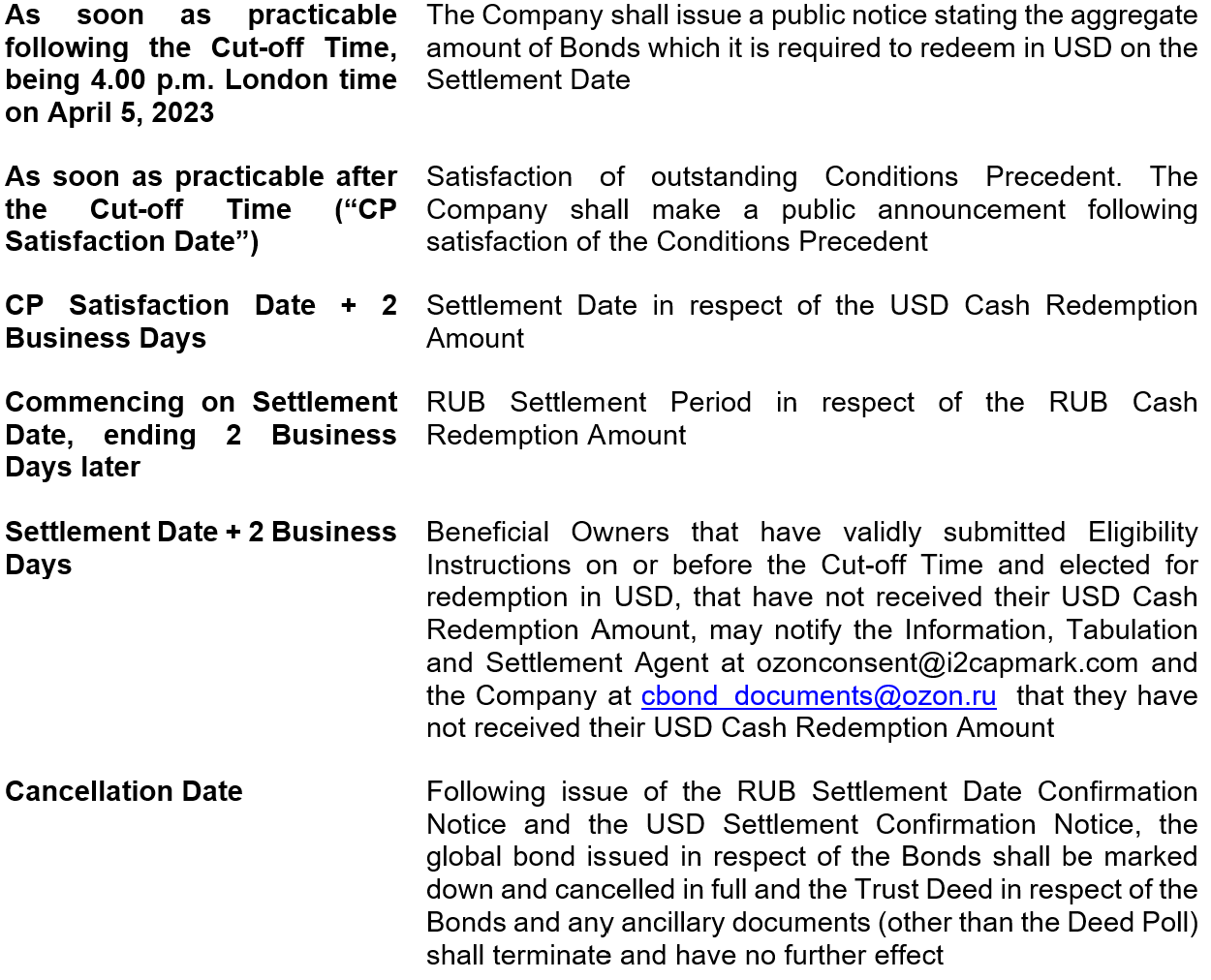

The anticipated timetable for settlement is as follows:

As announced in the Company’s press releases dated October 25, 2022 and December 23, 2022, the Company has received a license from the U.S. sanctions authority regarding, and approval from the Cyprus Enforcement Unit for the Financial Sector (MEK) to implement, the consents and amendments to the terms and conditions of the Bonds on the terms set out in the written resolutions duly passed on October 25, 2022 (the “Restructuring”) by the holders of over 75 per cent. in principal amount of the Bonds outstanding (the “Written Resolutions”). Unless otherwise defined, capitalized terms used herein have the meaning given to them in the Written Resolutions.

As announced in the Company’s press releases dated January 30, 2023, and March 14, 2023, the Company has been awaiting response from the UK sanctions authority indicating that no license or authorization is required in connection with the Restructuring or granting a license or authorization to implement the Restructuring. The Redemption Long Stop Date was extended to March 15, 2023 and then to March 31, 2023.

The Company hereby announces that the UK sanctions authority published, on March 28, 2023, general license INT/2023/2824812 relating to ‘Bond amendments and restructurings for non-Designated Persons’ (the “License”) which authorizes bond issuers and UK persons to effect the terms of the bond restructurings subject to certain conditions. The Company hereby confirms that the Restructuring and its implementation falls within the scope of the License.

Accordingly, pursuant to the Written Resolutions, the UK/EU/US Sanctions Approval Satisfaction Date has now occurred. Consequently, the Effective Date has occurred as of the day of this announcement.

The holders of the Bonds which have not submitted validly completed Eligibility Instructions are entitled to deliver validly completed Eligibility Instructions to the Information, Tabulation and Settlement Agent on or before the Cut-off Time, being 4.00 p.m. London time on Wednesday April 5, 2023, in order to receive the USD Cash Redemption Amount on the Settlement Date or, as applicable, the RUB Cash Redemption Amount during the RUB Settlement Period.

The anticipated timetable for settlement is as follows:

To facilitate settlement, and in accordance with the definition of the Redemption Long Stop Date, the Company and the holders as at the Record Date of over 33.4 per cent. in principal amount of the Bonds outstanding (including at least two members of the Ad Hoc Group) have agreed that the Redemption Long Stop Date shall be further extended to April 20, 2023.

For further information on the effects of the occurrence of the UK/EU/US Sanctions Approval Satisfaction Date and the Effective Date, including the detailed terms and procedure thereof, please refer to the Memorandum at https://ir.ozon.com/restructuring or https://i2capmark.com/event-details/68/Holder/ozon-consent-solicitation. All activities, transactions and other dealings contemplated in the Written Resolutions shall be carried out in compliance with Sanctions (including blocking and freezing requirements).

For further information on the effects of the occurrence of the UK/EU/US Sanctions Approval Satisfaction Date and the Effective Date, including the detailed terms and procedure thereof, please refer to the Memorandum at https://ir.ozon.com/restructuring or https://i2capmark.com/event-details/68/Holder/ozon-consent-solicitation. All activities, transactions and other dealings contemplated in the Written Resolutions shall be carried out in compliance with Sanctions (including blocking and freezing requirements).